Betting on the Jockey

Hello vision masters. This is Rob Kramarz, Robert Steven Kramarz of Intelliversity.

I'm going to give you a recap of a presentation I gave in front of an innovative business a couple of weeks ago. And it's called Betting on the Jockey, The Fast Track To Funding. Anybody who was there, remember no one got up to leave while I spoke 18, 20-minute-long TED talk type talk so I know this message resonated. Starting a business is like a surfer trying to catch just the right wave. The wave is the trend that you're trying to catch the time and then this happens and happens to all of us. So you got to try again. The fact is that of companies that are funded, only 10% ever succeed. So that means we've got to find big deals to cover for all of the other deals that don't succeed. We can only bet on the best shots.

So forgive the mixture of metaphors but I hope they illumination my words more than not.

Now that's a broken system. Imagine going to a race track and you're only allowed to bet on 10-to-one shots or longer. Well, you're going to wait a long time to find exactly the right bets. And what's really broken about it is that all the other bets, all the other companies that are maybe not billion-dollar prospects are not getting funded. And this is just wrong. It's wrong for society. It's wrong for me. And it's wrong for you because you have to waste months and years of your time finding the capital you need. And you don't have that time. Yet if you go about it the old way, the chances are only about 5% of you will ever raise any capital at all. This is not acceptable to me and we're going to go on now and show you how we and how you can break through this bottleneck and get your capital fast.

Your funding sources say you got to have revenue. Lots of revenue before we give you the money. But you know that you got to have some money before you reach that revenue goal. So now you're in a trap. You're in a catch 22, it's a problem. So let me talk to you as an engineer to engineer. When you're designing something, whether it's a business when you're trying to designing a product and a problem comes up that seems insoluble, do you ever allow that problem persist more than a day or two? No. You find a new approach, you go at it from all sides. That's what vision masters do. That's what engineers do. I'm asking you to look at this diagram and say to yourself, "No, I will not tolerate this problem. I will not allow a catch 22 to exist in my life for more than one day."

So we're not going to allow the gambling mentality to rule our lives. Now, here's a couple of guys that I actually dealt with earlier in my career and I got a call from Bill Gates who I knew - we were not friends, but we knew each other from hanging around the computer conferences and he said, "Come on up to... Rob, come up to Seattle. Let's have a talk about an opportunity for you." And they suggested we'd like to ask you to be our director of sales for North America. I thought about it for a few minutes and declined.

The guy who did take the job went on to become the CEO of Microsoft and he's now worth $49 billion. And I'm not worth $49 billion. But I did learn something from that experience. And one thing I learned was like the old saying, the pessimist goes into a room and sees, sees a pony and says "That's just a bunch of horse manure." And the optimist goes into the other room and sees a bunch of horse shit and says, "There's got to be a pony in here somewhere." So what I'm asking you to do is take a serious look at the other road, the road less traveled. It's the road that's going to reach capital quickly, but you're going to have to do something differently.

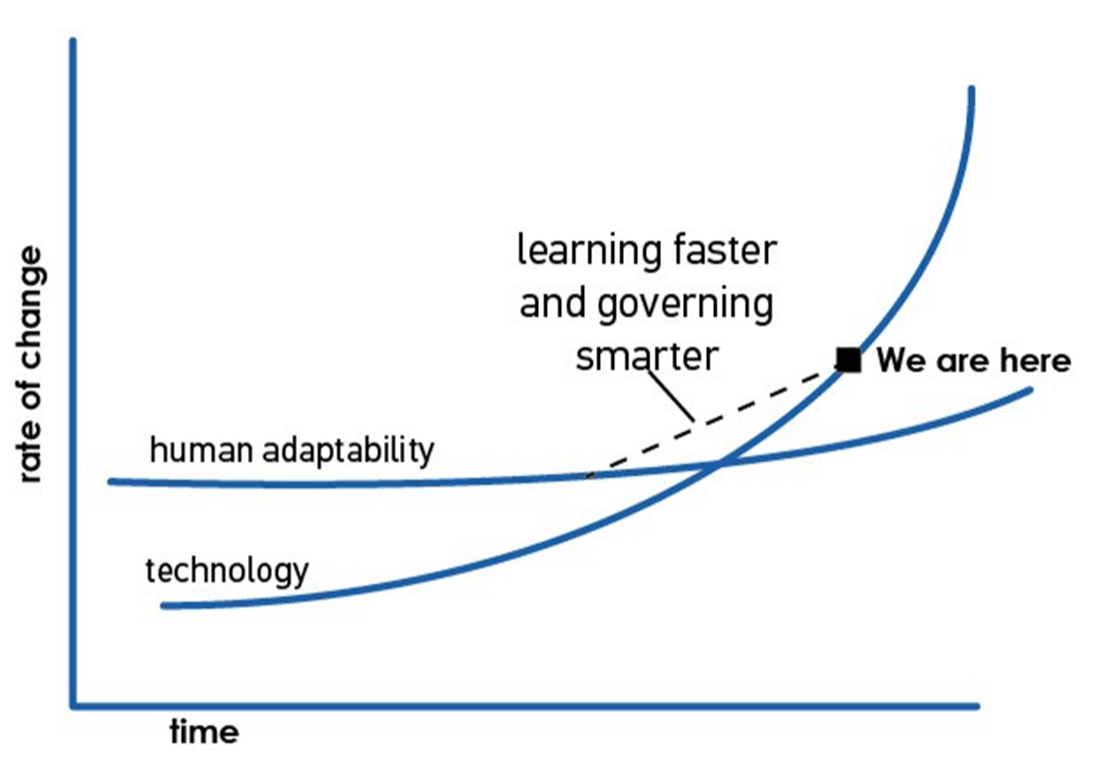

And the problem is that you're dealing with is something you need for our era. And the problem you're dealing with that's unique to our era is that technology change has gotten so fast that it's now outstripped our ability to stay up with it. The future says we've got to learn faster and learn to govern our ventures smarter in order to keep up with the technology change. But the same thing applies to raising capital. And the problem comes up this way. If you look at the blue line here, that is the amount of time over which we can see the future. There was a time when we could see the future, maybe five, 10 20 years ahead, accurately. At the present time, that point of opaqueness has moved closer than five years. But the other line shows you how much time it takes to exit.

When that keeps getting longer, the average is now nine years. So if you have to assume you're going to exit nine years, but you can only see the future three to five years out, then you have no way to predict whether an exit is possible. It's a gamble just like we saw before. And that's the situation investors are finding themselves in is that every deal is a gamble. It doesn't matter how well you present yourself. It doesn't matter how well you talk about the facts. There are no facts in your business plan or your pitch deck that can possibly predict the future nine years from now.

So this puts you in a position of betting on horses. So put yourself in this position. You've got a bunch of horses and you've got a bunch of jockeys, and you're trying to bet which horse is going to make it to the finish line first. If you go on the basis of the horses' statistics or the track is changing every day and the food is changing every day and the other horses are changing every day, there's no way you can predict which horse is going to make it to the end line first. But if you bet on the jockey, and this is more important as the problems surrounding the horses get larger and faster all the time, then you've got to bet on the jockey and that's what we're going to teach you how to do. Now you're not the bettor, you're the bettee. You're the jockey, so you've got to be the jockey that the investor would bet on.

Imagine you're in this situation, you're the investor, you're sitting on the shore. You've been given 10 boats to bet on. Only one can get to its destination. The chosen destination is Calcutta. And out there in the wide-open ocean are typhoons, monster waves, pirates, shipwrecks, enemy navies, and sea monsters. Which boat's going to make it. Do you bet on the boat that has the best keel or the best navigation equipment? What's the best way to predict which boat's going to make it?

Well, if you think like an investor, you say to yourself, "No, boats will make it. They'll all crash and burn." But one will recover from the crash, rebuild the boat and go on further. Maybe crash the second time, rebuilding the one that goes on to get to Calcutta. So how do you know which boat is going to do it? What do you bet on? I think you've got the answer already. You have that on the vision master. You bet on the captain. And that's even more important today.

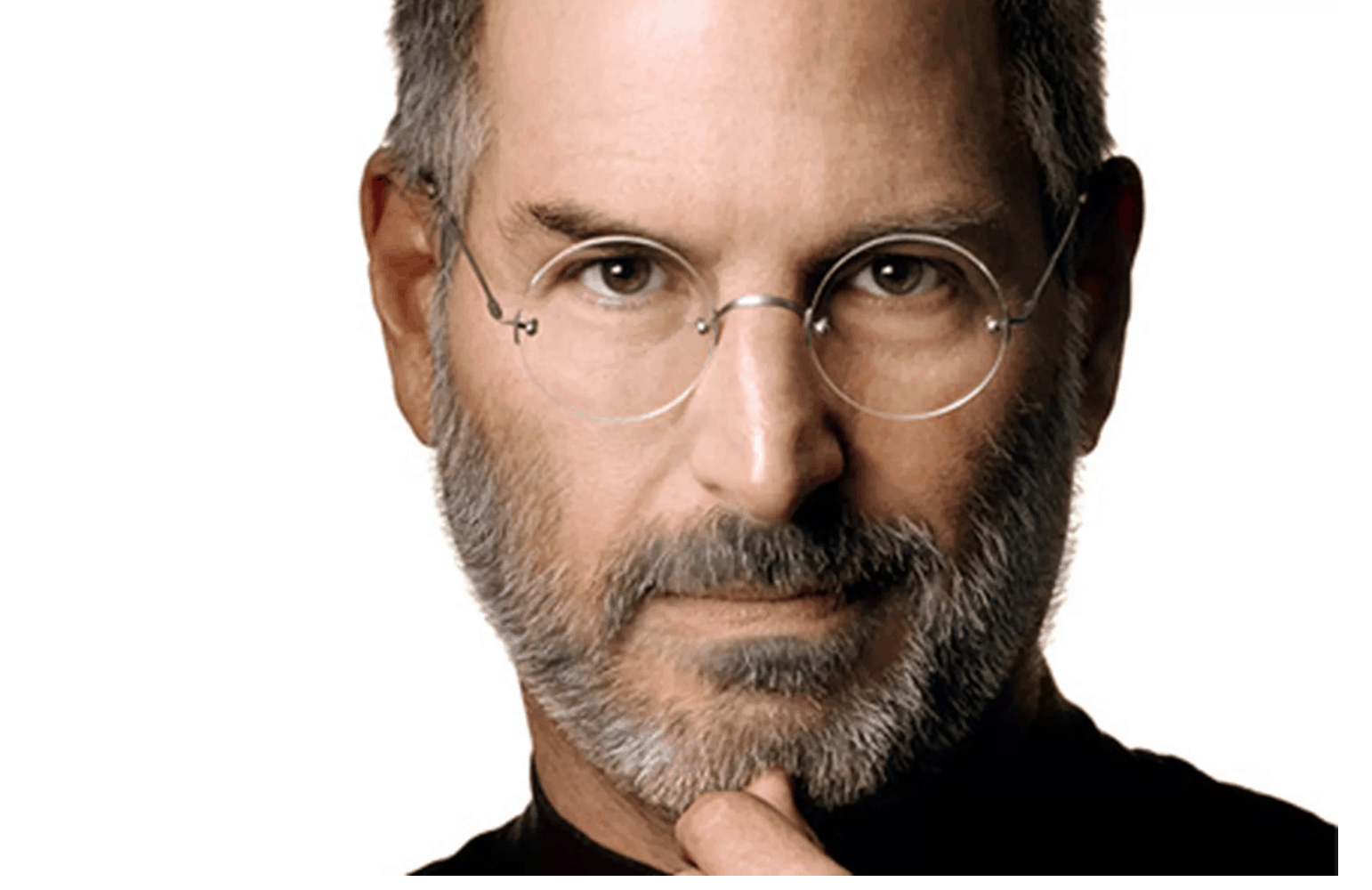

Here's a guy that did become a vision master, but the first time around was a washout. Brilliant, persistent, but a wash out the first time he's tried to start a company. And then he went and learned his lesson with a few more companies and came back to Apple and triumphed. What did he do differently? What changed over that time?

I maintain that Steve learned to hire trust and delegate to an execution master. Steve's division master, Tim Cook's the execution master. No one will deny that everybody who knows them knows that's how the dynamic work. Steve had the long look, the long view and Tim Cook manage the company on a week to a month to quarter basis. Now that worked. What Steve Jobs developed in the time away was the ability to select trust and delegate to his execution master and the team that they surrounded themselves with.

Here's another one, Melanie Perkins. Now Melanie is the founder now billionaire of Canva, which is based in Australia. Visionary in every respect and a master at running the business. And what's the key to Melanie's success and running the business to make it so successful. She has learned that being a vision master means surrounding herself with execution masters. People don't do the day to day and the month to month with greater clarity and precision that she does that she wants to. But what I'd like to do is hold up the two faces of Elon Musk to you and say, here's the one face we have the vision master Elon Musk, and the other face we have the visionary Elon Musk.

Why? How how does one person manage to manifest two different personalities as well? I don't have the answer to that, but I can show you one. The woman below is Gwynne Shotwell who actually runs Space X, not Elon. He's an engineer there, the chief engineer, the chief visionary, but she runs the company. And he selected her, trusts her and delegates to her. Now, a lot of being a vision master it has to do with balance. Because when you think about it, don't get into like trust in an execution master really a matter of balance.

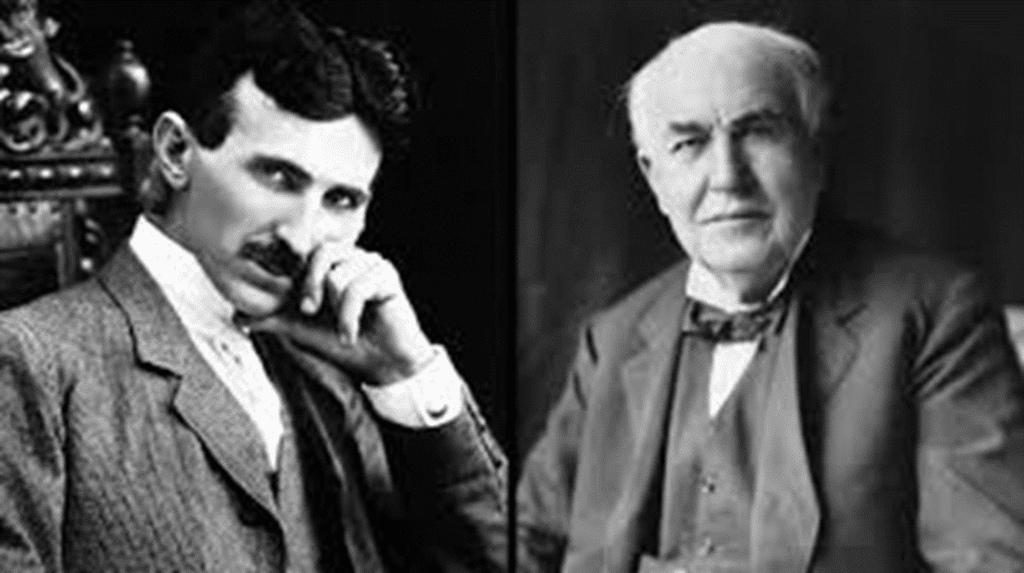

You can't give everything to the execution master. You just have to know how much to give and how much to keep. The same thing goes... You see it's a balance, delegation and take on yourself. And the same thing is true for am I a thinker or am I a doer? Some of your time to spend thinking and some of your time is spent in action even as a vision master. Too much of one or too much of the other is not going to work. So as a vision master you learn to balance the two. Now here's a couple of guys that's clearly a vision master execution master combination. Nicholas Tesla on one side and you have Thomas Edison on the other side. Tesla is clearly a vision master. And clearly Edison was the execution master, the guy that surrounded himself with brilliant inventors and if you will develop their ideas into the marketplace. Took their ideas into the marketplace.

He had the ability to select, motivate, delegate to and trust his inventors. He was also a great inventor himself. But more than that, he was an execution master. Some of you may hold it that Edison was the devil and Tesla was the angel. But really that's not the case. Really the case is that the two worked together, hand in hand, vision master and execution master to make the future real. And this is the future of the electrical age that we now live in today because of these two guys. So look, you can either be alone on your little boat looking at the future, you're the lofty visionary or you can be the involved vision master, pulling your team along with you, always showing the way trusting and delegating and allowing your team to do their job.

Let's come back to what it's like going in to see an investor. So you go into an investor. Now that you have this point of view, you're asking the investor to bet on, well, on the two of you, the jockey and the horse. Now, if you're smart, if you're really a vision master if you've developed yourself into one, now you ask the investor to bet on you, the jockey. The problem is that he doesn't know how to do that. The problem you have is you have to show him how to do that because if you don't show him, he's going to bet on the horse. It's all he knows how to do.

Your job is to be as attractive as you can as the jockey. And the question is how? You've got to provide a lens. You've got to give a lens for the investor to look at you through so that he or she can see you clearly as the beautiful, the powerful leader that you really are. The effective vision master that you really are and not in some biased way is whatever they think you are.

And I'll get to that in a second because as soon as you allow them to see you through their lens and not your lens, they'll go back to betting on the horse. And the reason is is because they are driven by, like all of us, biases. They see you in whatever way that they're already trained to see it. You have to take them away from their biases and give them a lens to see you through accurately as a vision master and that's going to turn the trick. But of course, how do you do that? And the answer is it's largely done through telling stories. Well, a story is like an image. It's like presenting your audience, your investor with an image of who you really are. And this is what happens when you tell the story of your life, I don't think the whole life, but you tell a few select stories that illustrate the key events in your life that made you into the vision master you are. You want your potential investor to see you, the winning jockey bringing it home to the finish. Maybe even cheering you on!

If you remember from earlier, I gave you two stories. One was about my experience with Bill Gates and one was about a betting on some boats, right? I'm going to bet you that those are the stories you're going to remember tomorrow and the rest of the detail would be kind of fuzzy. But those stories you'll remember because stories are unforgettable. They're the way that we transmit knowledge most effectively and the knowledge you're trying to transmit most effectively is your balance, your the vision master. You have to balance expertise and you have to balance your coachability with your expertise.

When you tell the right stories, your investor will get in their gut that you are a vision master they can trust, that they can count on. Now there are, I've counted them, nine specific techniques you can do and use to pitch to win, which means to make sure that the investor sees you as a vision master, sees you through the glass the way you want to be seen. I'm not going to go through these in detail. We've talked about a few of them so far. These will be found in much greater detail and in clear examples in our program fast track to funding what you can get separately.

The bottom line, if you want to be a vision master, you have to learn to play on a team like a quarterback. The investor may be willing to bet on the jockey but he or she will want to see how well your team functions. Is it a Super Bowl team? And so you've got to play the role of the jockey and the quarterback and therefore surround yourself with the right team and you've got to trust them. That's the most important attribute of the vision master. By the way, not the only aspect of the vision master, but the most important. What is the coach that you want to guide you in the development of the presentation of you as a vision master? The question is taking who you are, can you present yourself as a vision master? Can you tell the right stories that present you as a vision master? Then then you'll be able to ride the horse. You see it's still you, but you're learning to ride the horse properly and we're the coach, we're the mentor that's going to stand by you. Or, if you are a surfer, we ride the wave with you, so hang on!

And different than a coach, not... Whereas most coaches just point out you should do that or you how you should ride the horse, we ride with you the whole way. It's a lifelong partnership in some way or the other we'll be doing this together for the rest of our lives. We must if we're going to fulfill our vision, ride with you, make sure you succeed and that means succeed first in getting the capital quickly and then secondly, executing on that capital when you get it. And by the way, there's a third factor which we'll talk about in fast track to funding, which is making sure you don't have to give away the company when you get the capital. It is very important to have the right valuation, so the company has to be perceived as worth what you think it's worth.

Which is very much the same as telling stories and we'll get to that some other time. Go to the next one. The end result is you keep the bulk of your company's assets equity. You got the right capital, you get it quickly because you're on time. The wave is still there and this is the result. You know, you're breaking through and you're having fun at the same time and its glory day and surf time.

It's making your business successful on the wave that you chose to ride. I want to be there with you. Next one. And if we do that together, we can build anything. Now, this particular object that you're viewing here is already built. So together, we're part of a movement, a movement to enable entrepreneurs, innovators to move away from just being visionaries, to being vision masters. If this is a worldwide movement, we're going to change the world in a positive way quickly and we'll move forward to the next level, which is shown here. And on from there, anything is possible.

This is Robert Steven Kramarz of Intelliversity. Thank you, vision master.