I love a good mystery. I’m the guy who usually figures out the plot to the movie halfway through. Honestly, it’s fun but also a little disappointing to solve the plot too early in the film. That’s why I love a plot that stumps me right up to the end. Today I’d like us to have a little fun solving a mystery. We’ll have a good time, but trust me when I say that for many of you, solving this mystery may just show you the path to massive success.

For years we’ve explored strategies for success in developing your team, finding capital, scaling your enterprise, pivoting, etc. Not every strategy or tactic works for every business or is even appropriate to every situation. Finding the right approach is akin to solving Rubik’s Cube — there are hundreds of ways to solve it, yet most people don’t. Having an experienced guide helps. Having an open, inquisitive mind helps. Ambition, linked to a strong purpose, is important as well. Lot’s of factors make a difference in skewing towards success or failure.

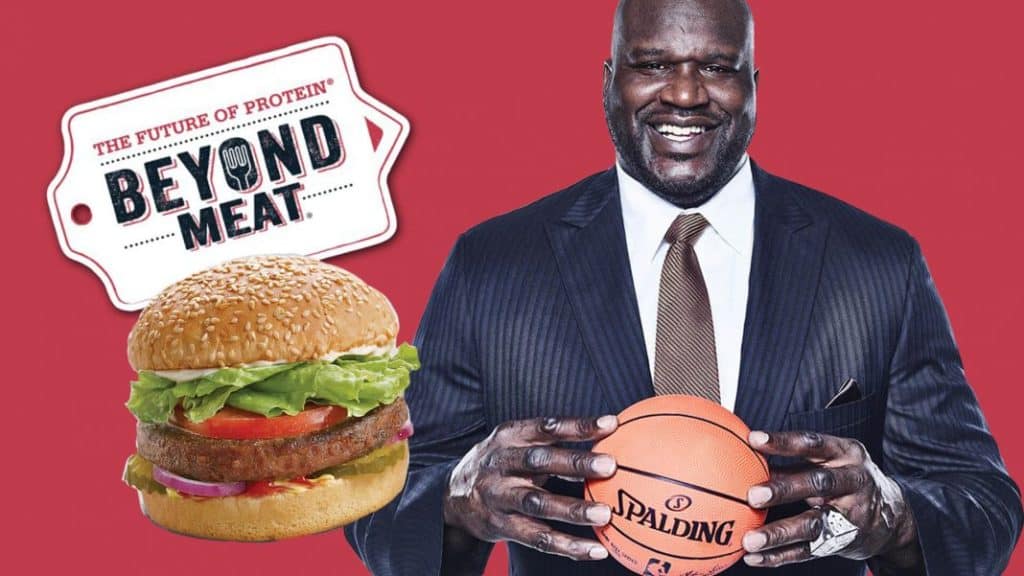

Let’s explore this by solving the mystery to the success of Beyond Meat, a company founded by vegan Ethan Brown in 2009. Beyond Meat went public last week, raising nearly $250 million dollars. Not only was the raise itself noteworthy, but the stock ended its first day of trading at about $65 per share, 163% higher than its initial offering price of $25 per share. The company now boasts a valuation of $1.5 billion dollars.

The question is, how did they pull this off?

Let’s start with some essential facts:

- The company has never been profitable in its roughly ten years of existence

- The company makes meat substitutes, a tiny niche market in the food sector

- The company is just one of several comparably-situated competing firms

- The company is in breach of contract/trade secrets litigation with a co-manufacturer

- The company relies upon just two suppliers for nearly 80% of its necessary raw materials

Profitability has never been required for a successful IPO (see Amazon, Tesla, etc.) but, combined with the other factors listed above, it all creates an investor risk profile that wouldn’t lead us to think this would be the best performing IPO in 20 years!

Pardon the pun, but “where’s the beef?” (our mystery-solving will be a pun-filled mission)

Therein lies the mystery for us to solve. But the plot thickens, too . . .

- Beyond Meat is not a “tech company,” and has no Silicon Valley roots (pun unintended),

- It’s run by a first-time entrepreneur whose background is in the fuel cell industry, not the food industry.

- What’s more, the company’s products are surely intended for a tiny niche market, right? The meat substitutes market is dwarfed by the beef/poultry industry. In fact ‘dwarfed’ isn’t even a strong enough word. One of the key early backers of Beyond Meat, former professional basketball player John Salley, said on CNBC that only about 3% of Americans are vegans. That’s about 12 million people. Does Beyond Meat plan to sell faux burgers or chicken-less wings to every single one of them?

When you add up all of these factors, the stunning IPO of Beyond Meat is ‘rare’ indeed. We must certainly say, “well done.” We wonder how in the world its prospectus stood up to the ‘grilling’ it must have gotten from market-makers. We can’t help but think that most institutional investors would have considered Beyond Meat to be a ‘turkey.’ Perhaps CEO Ethan Brown is a real ‘ham,’ cut from the same cloth as iconic leaders like Steve Jobs or Elon Musk.

We could go on ‘roasting’ Beyond Meat, but the fact is something caused investors to ‘flock’ to its IPO. Whatever it was, understanding the phenomenon could be beneficial to every Vision Master who wants to bring his/her idea to the world. As I looked into the Beyond Meat IPO more closely, got under the ‘skin’ of it, I found four clues that, for me at least, solved the mystery. Let me share the clues with you, then you can decide for yourself.

Clue #1: CEO-Founder Ethan Brown exudes trustworthiness

We’ve covered the importance of trust many times in this space. You’ll recall that trust comes in many forms. People exude it (or don’t) in a variety of ways. For some, competence is their calling card. Others have a way of demonstrating their brilliance, work ethic, or relevant experience. Mr. Brown has a share of each of these characteristics, but none of them really defines his trustworthiness. It actually comes from his personal story. I can tell you from experience as an investor that a personal story that identifies a struggle, which led to the development of a product or service that solved the problem, can generate a lot of initial trust. I’ve mentioned in discussing effective pitching that telling a story involving struggle, plus overcoming that struggle, is a powerful strategy to develop trust.

In Mr. Brown’s case, there was a lifelong struggle with the ethics of eating animals, punctuated by the birth of his children. He relates that he simply couldn’t stand the idea of raising a family of carnivores, given the mounting evidence of the environmental and health costs involved. This, coupled with his own feelings about whether eating animals was ethical, created a conundrum for Brown: how to feed a growing family without meat.

This led him to spend evenings after work researching the components of meat. Ultimately, Brown discovered that each of the constituent elements in meat — amino acids, water, carbohydrates, lipids, trace minerals — could be derived from plant sources. The problem was how to make it taste like actual meat, which no current meat alternative has ever really mastered. Brown quit his day job in fuel cell technology, along with all of the benefits of job security, to launch Beyond Meat, with a fervent belief that he could solve the flavor/texture/aroma deficiency of meat alternatives. His goals: personal — solve his ethical dilemma; family — raise healthy kids; planet — reduce the carbon footprint of food; people — enhance well-being globally. Honest, admirable goals, whether we agree with them or not, they exude basic trustworthiness, a sincere desire to contribute to positive change.

This led me to deduce that one key to the astounding success of Beyond Meat’s IPO was the character of its CEO.

Clue #2: Beyond Meat has a gigantic purpose

Hidden in the Company prospectus, as well as in the articles or interviews published recently, is a totally audacious goal: to make meat without using animals, then to convince you and me to eat it. Forever.

The Beyond Meat business plan requires tens of millions of meat-eating people to stop eating animals, instead getting their meat-eating pleasures from plant-based products. That’s right, Beyond Meat is NOT trying to serve the tiny vegan/vegetarian marketplace of today. It intends to make us all vegans by proving we can get the same pleasures we derive from biting into a juicy steak without using the cow. The ‘secret sauce’ involves de-constructing the constituent elements of meat, then replacing each with a plant-based alternative, to create the same flavor/texture/aroma that makes our mouths water at the site of a steak on the grill.

Investors love a gigantic, audacious purpose. But be careful here — I do not mean a crazy, otherworldly, pie-in-the-sky purpose. Brown clearly had some good facts at his disposal when speaking to early investors. First, the tremendous cost of eating animals was easily proven with existing data showing the carbon footprint of meat. Secondly, the health concerns related to a carnivorous diet were well-documented by reliable sources. Third, the environmental impact of the billions of animals required to support our meat-eating diets (66 billion animals are slaughtered annually) was reliably proven through valid data.

The unknown question was would Beyond Meat be able to massively change human behavior?

I believe, though I have no proof, that Brown probably gained investor trust early on by saying something like “we don’t know . . . but imagine if we could. Imagine what the world would be like, how our health would be improved, how energy usage would be reduced, how much water could be saved, how much cleaner the air we breathe could be… .just imagine all that for your children, you’re grandchildren.”

I gather that may have been the essence of Brown’s pitch, because in published interviews he talks about developing the courage to be compassionate, to boldly say ‘this is who I am, this is what i believe is right.’ Even if investors disagree with his ethical position, even if they feel it is a long shot to expect massive human dietary change, they are still compelled by the audacity of the goal, by the sheer boldness of vision.

I deduced that another key factor in the successful IPO of Beyond Meat was its massive, audacious, inspiring (to some anyway) goal of changing global dietary habits.

Clue #3: The Company was founded with the right team composition

I may have downplayed it earlier, but it’s important to recognize that Beyond Meat developed a strong beachhead years ago. While the Company hasn’t shown profits, it has produced significant revenue. So, this was not an IPO based solely on projected future value. Brent Taylor was one of the key people to develop the branding and marketing of Beyond Meat’s products. Taylor has since moved on to form his own startup in the nutritional beverage market. I haven’t had a chance to interview Brent or CEO Ethan Brown, so I have no clue what caused Brent’s departure, but it’s clear they’d been together since nearly the start in 2010.

My research shows that Taylor, a graduate of the Wharton School of Business, who joined Beyond Meat in 2010, played the Execution Master role during Beyond Meat’s key growth period. During his tenure, the Company’s products found their way into several thousand grocery stores, including Whole Foods. The Company also engaged in promoting the brand to professional athletes, gaining several endorsements along the way. Though Taylor moved on well before the recent IPO, the Vision Master/Execution Master partnership he forged with Ethan Brown allowed Brown to focus on food science, technology, fundraising. Taylor led marketing while managing some of the day-to-day issues at the Company’s marketing-focused LA office. Interestingly, some of the first institutional investment (from Kleiner-Perkins) came to Beyond Meat during Taylor’s tenure. In fact, Taylor was completing due diligence research for Kleiner-Perkins on Beyond Meat, which is how he met Ethan Brown.

As I’ve so often stated in this space and in my book Born to Star, there is no more effective ingredient in the recipe of business success than a co-founder with Execution Master skills and leadership style, while sharing the same basic passion and values. Beyond Meat seems to have had exactly that. If you’re a Vision Master trying to do it alone, consider the importance of bringing on an Execution Master right away. Business is too fast, too complex, too competitive to go it alone. As talented as you may be, you simply don’t have all the various skills required, much less the time in your day, to master everything. Find your own Brent Taylor. Handoff the day to day to him or her. Forge a trusted partnership. Rely on your Execution Master’s talents to help you move from concept to market. Even if he or she moves on as Taylor did, they’ll leave you in a far better place than they found you nearly all the time.

I deduced that the familiar Vision Master/Execution Master pairing that so often leads to success was at work during the crucial years when Beyond Meat went from cool idea to beachhead to growth phase.

Clue #4: The Company has key influencers among its shareholders

When you have an audacious goal, such as banking on changing well-entrenched consumer behaviors, you’d better have some high-powered influencers to help get your message out to the masses. As I looked more deeply into the background of Beyond Meat, I saw that several key influencers were early backers. This includes Bill Gates, Twitter executives Ned Segal and Christopher Isaac, and professional athlete John Salley. The money they invested was probably only a small percentage of the value they’ve brought to Beyond Meat. Think about the credibility, connections, publicity this group of celebrity investors brought to Beyond Meat . . .

You may not know any celebrities. Your Rolodex may not include senior executives of iconic companies. But my guess is that neither did Mr. Brown’s. His father was a college teacher who also owned a dairy farm. Brown spent his life in college towns, in pastures. He was working a middle-level job with a fuel cell company far from Silicon Valley.

But he did have a knack for gaining publicity. Early influencers may have played a key role. Perhaps some investors were impressed by a 2014 New York Times article in which professional food journalist Mark Bittman wrote, “you won’t know the difference between that [Beyond Meat] and chicken. I didn’t, at least, and this is the kind of thing I do for a living.” Possibly investors noted the comments of celebrity chef Alton Brown, who said in Wired Magazine (also in 2014) that Beyond Meat’s chicken product tasted “more like meat than anything I’ve ever seen that wasn’t meat.” Likely, it was the combination of Mr. Brown’s strong purpose/audacious goal, coupled with his initial published success in making plants taste/feel like meat. Beyond Meat’s growing presence in grocery stores (products are currently in 11,000 stores) certainly helped as well. Heck, even Tyson Foods bought a 5% stake in 2016!

I deduced that early influencers, who probably helped Beyond Meat get noticed in the world, played a key role in its attractiveness to the investment community when it offered shares publicly.

A trustworthy CEO + an audacious, inspiring purpose + proof of a great product + a competent Execution Master on the team + powerful influencers at an early stage. That seems to have been the ‘recipe’ for success.

Mystery solved.

Now, how can you put some of these factors to use to complete your own success story?

Key Points:

- There are many paths to business success – part of your job as Vision Master is to explore them all

- Your success story is a mystery to solve – applying your facts/realities to the right strategy is the solution

- Trust trumps everything else – find your best way to exude it, often its right there in your own story

- Investors love a huge purpose, an audacious goal – as long as it is grounded in reality

- A competent Execution Master with complementary skills and aligned values is essential to make all the other ingredients work together well

- Influencers help you cross the bridge to success – you can find them even if you don’t yet know them