Revenue Royalties – The Easiest Way to Fund Most Young Companies

Revenue Royalties – The Easiest Way to Fund Most Young Companies As an investor, it’s become apparent there are major drawbacks to two of the common means of funding young companies: selling ownership rights (C-corp stock or LLC membership) and issuing a note (convertible or not) – i.e. borrowing money from investors. The good news […]

Revenue Royalties – More on Community-Based Revenue Sharing

Revenue Royalties – More on Community-Based Revenue Sharing In my last post, I hinted at a way to raise capital for the 80% to 90% of growing companies that don’t qualify for sophisticated angel financing or venture capital, or don’t want it. One good reason not to want to get capital from sophisticated angel investors […]

Participation funding — Win-Win Funding for Young Companies

Participation funding — Win-Win Funding for Young Companies This time period has been eventful, including attendance at CEO Space and discussions with many companies about the topic of the last two posts: how to raise funds for a young business without 1) giving up a lot of ownership nor 2) burdening the company with a loan having […]

Revenue Participation Funding: It’s Here Now

Revenue Participation Funding: It’s Here Now Today, I want to bring you up to date on a favorite topic: Revenue Participation Funding — the idea of selling (or buying) a share of a company’s revenue rather than a share of the company ownership. This method is in contrast to traditional methods of finance such as […]

Red Flags that Turn Off Venture and Angel Investors

Red Flags that Turn Off Venture and Angel Investors This is the second installment of notes I took at the New York Venture Summit on a hot summer day in Manhattan, July 25, 2011. These notes came from the fourth panel entitled “What Should You Do to Get VC’s and Angel Investors to Say Yes?”. […]

14 Things That Shorten the Time to Angel and Venture Funding

14 Things That Shorten the Time to Angel and Venture Funding This post continues my notes from the New York Venture Summit on July 21, 2011 — in particular, the panel entitled “The Venture Roadmap: Making Sure You’re Headed in the Right Direction and Advice on how to effectively shorten your time to Angel and Venture funding.” […]

10 Steps to Angel and VC Funding in Uncertain Times

10 Steps to Angel and VC Funding in Uncertain Times Naturally, when there is a lot of uncertainty about the economy, some investors hold more capital in reserve and others focus on less risky investments. So less cash is available for risky investing like angel investments and VC funding. That explains why it’s been more […]

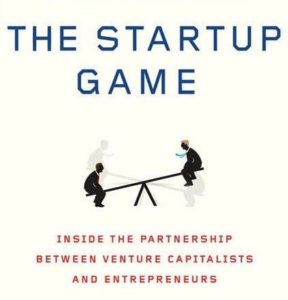

William Draper – Advice from a True Venture Capitalist

William Draper – Advice from a True Venture Capitalist The Startup Game — Inside the Partnership between Venture Capitalists and Entrepreneurs was published this year by William H. Draper III, currently general partner of Draper Richards and the founder of Sutter Hill Ventures in Palo Alto, one of Silicon Valley’s first VC’s. William Draper is the real […]