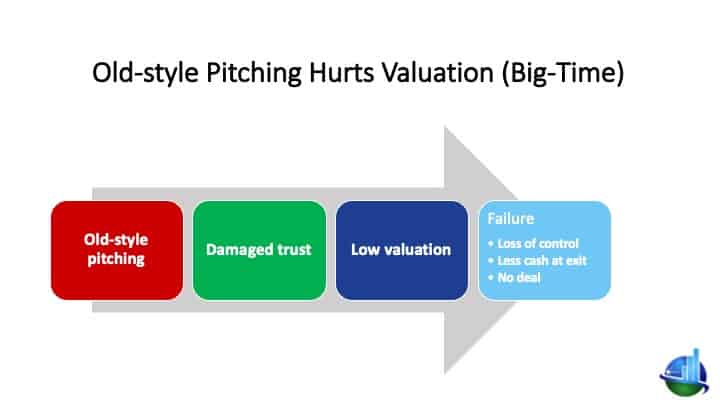

When you seek capital, a growing company’s investor valuation is critical because if you get funding and your valuation is low, you’re going to lose control of the company or at the very least have less power. And you’ll have less cash when you exit. The effect of a low valuation is substantial on these factors. Or you may get no deal at all because you can’t agree on the valuation, which is the most common source of disagreement between investors and company owners.

So what’s behind low valuation?

Behind low valuation is decreased PERSONAL trust in you and your team. And the cause of damaged personal trust is old-style pitching, i.e. the WAY you pitch. It’s not WHAT you say so much, it’s more HOW you say it. Old-style pitching is classic selling; present the facts (such as features and benefits) and persuade the audience that your company will have a certain level of sales and profits. Old-style pitching is based on logic spiced with a little passion. Unfortunately, it doesn’t work with investors.

Looking at the above diagram, you may imagine I’m asking you to work harder at getting your prospective investors to believe your projections and everything else about your company, product, and market. This is emphatically NOT what I mean. What I’m saying here is that your listener’s willingness to believe you (on ANY topic) is destroyed by fear and mistrust. Chances are they come to the meeting with you already sizzling (inside) with fear and mistrust. You’ve got to address this problem FIRST. You have to address and remove their fears and mistrust before you have any shot at being believed in any statement you make about your product, market, background, or company. Before giving you a pathway to addressing and removing fear and distrust, it will be helpful to understand how fear and distrust control their willingness to believe anything you say. It may seem obvious but it’s not.

What’s not obvious is the mechanism (in their minds) that controls the willingness to believe you. Their willingness to believe you are based on the fact that most investors have a cynical, skeptical side. I think of this cynical, skeptical side as an investor’s “dark side.” This cynical, skeptical side of your investor candidate is NOT your friend. Your job is to keep the cynical, skeptical side asleep, at least for a while. Your job is to avoid waking up the investor’s cynical dark side. This is easier said than done.

Another way to view this has been covered in earlier blogs I’ve written: everything you say, when you first meet someone, is filtered through the primitive “croc” brain also known as the “old” brain or “reptilian” brain. This part of your listener’s brain is concerned with basic responses to people such as fear, excitement, boredom, desire. The “croc” brain in your listener’s head does not allow your listener to think rationally (using their rational cerebral cortex) until such reactions as fear and boredom are removed and replaced by desire and excitement.

Why is this so hard? The problem is, as you make your financial projections grow higher, your listener’s visceral fear and distrust also rises. The cynic in them wakes up. The “croc” brain blocks your statements. In layman’s terms, you’ll seem to be a “salesperson.” This salesperson “vibe” results in an untrusting personal relationship, which creates disbelief, which results in low valuation, which means you lose control and have less cash.

Before you find out how to fix this (given below), you need to know how this process works in the mind of the investor. Exactly how does an untrusting personal relationship damage valuation? It may seem obvious, but breaking this down will lead to the answer. Hang in there …

In order to find a new way to pitch, you need to understand exactly how the absence of personal trust (in you and your team) reduces valuation. What you may not realize is that, when there’s low personal trust in you, you’ve awakened the skeptical dark side of your investor. This causes disbelief in everything you say. When an investor doesn’t trust you personally, they also don’t believe you. THIS IS THE KEY POINT. Once trust is lost, and the investor’s skeptical dark side is awake, anything you say is suspect. This puts your investor prospect into a highly undesirable state of mind: negative thinking. Technically, what’s happening is that your listener’s “croc” brain causes your listener’s cerebral cortex TO LOOK FOR PROBLEMS. In other words, your listener’s croc brain triggers negative thinking. You do not want your investors to be in this state of negative or skeptical thinking. You’ll know it when you see it; it’s like they become a different person. And negative thinking is a consequence of not trusting you personally. Before I reveal how to reverse this process and boost valuation, let me answer this question: How does this negative, skeptical thinking kill valuation?

Once an investor gets into a dark state of disbelief, skepticism or cynicism, they don’t believe your specific claims: 1) They don’t believe your financial projections. 2) They don’t believe you have the ability to execute. 3) They don’t believe that you can manage your cash. 4) They don’t believe can pivot or keep track of changes in the environment. They just don’t believe any of your claims. And once this dark side process takes over, all is lost. All of that investor disbelief results in low valuation.

But how does disbelief result in low valuation?

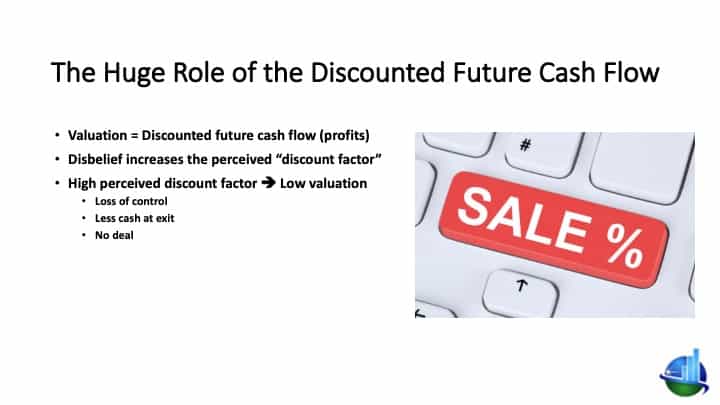

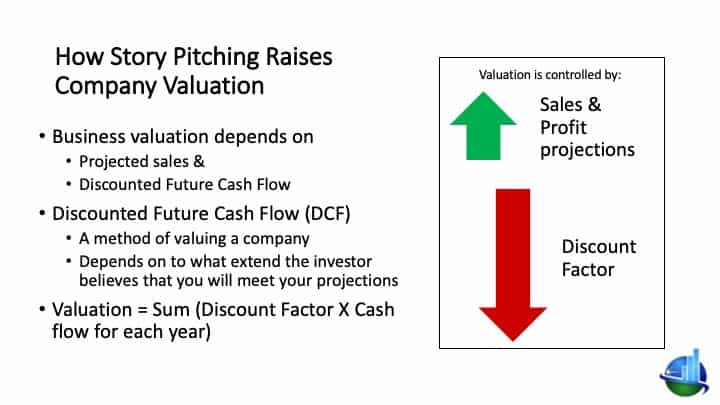

Well, you have to understand that valuation is a mathematical process called discounted cash flow. Cash flow refers to your operating profits. There are two pieces to this—your projections of profits and the perceived discount factor. Since you’re running an early-stage company without a lot of history and comparable companies, the discount factor is in the mind of the investor; it is simply a subjective perception, not really based on facts. It’s based on belief.

Therefore, your valuation depends on two factors: 1) The projected sales and profits of your company over the next, say, five years. And 2) this subjective discount factor, which is just in the mind of the investor. Remember the (simplified) formula: Valuation = cash flow X (1-discount factor). This is repeated (in the mind of the investor) for each year in the future. The discount factor is compounded. You can see that a high discount factor means that your cash flow in years 3 to 5 has relatively little impact on valuation, in the mind of the investor. If you want to know more about how investors do this calculation, I’ll cover it in a coming blog. You don’t need to know the math. What’s critical now is to find out how to reverse this process and create belief in your claims.

Increasing investor valuation

Here’s the key point: If the investor doesn’t believe you, they will assign a high discount factor. This higher discount reduces your valuation.

The most powerful way to impact valuation is not to inflate your sales and profit projections. Think about it: This exaggeration makes you even more unbelievable. How? exaggeration decreases visceral trust and therefore increases disbelief. In brief, you gain nothing by trying to exaggerate sales and profits in the future. You need a different way to boost valuation than exaggerating sales and profits.

Fortunately, if you increase trust, you decrease disbelief. To be accurate, you put the disbeliever (the cynical, skeptical dark side of your investor) to sleep for a while. Then whatever you do claim as future sales and profits will be believable. And this will positively affect your valuation. This is why investor perception of the discount factor, which is determined by how well they believe you, is critical.

So the answer is you have to find a new way to pitch that does not damage personal trust. In fact, your way of pitching must CREATE personal trust. Here’s how.

How do you increase visceral trust in you, which stops the investor from slipping into a skeptical mode, which decreases disbelief, which increases belief in your claims, which then decreases the discount factor and (finally) increases valuation? (That was exhausting just to write, so if you have to reread it, that’s normal.)

Go to the heart of the matter. INCREASE VISCERAL PERSONAL TRUST.

Trust is a visceral, personal, unconscious, almost “emotional” response to you. It’s definitely NOT rational. You cannot control trust by what you say. You control trust ONLY by HOW you say it. You control trust by HOW you pitch, not by WHAT you pitch.

So how do you control trust?

You can increase trust by story pitching. You increase trust by telling the correct stories. Rather than state simple facts and pure logic, use stories. Because at the beginning of a pitch, the investor is not thinking logically. They’re trying to determine if they can trust you as a person. That’s the most important thing that’s going on in their head. And if you try to dump a lot of facts on them before they trust you and don’t believe them, and you haven’t gained anything.

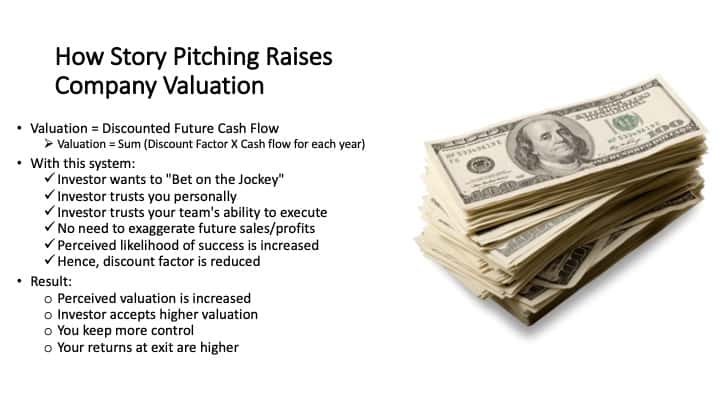

With story pitching, an investor begins to trust you personally. So they want to bet on you and bet on the jockey. And they will trust your team. They’ll believe your team’s ability to execute. So you won’t have to exaggerate future sales and profits. They’ll perceive your likelihood of success to be high. And so, all of this adds up to a lower discount factor in the mind of the investor. And if the discount factor is lower, the valuation is higher. The investor will accept a higher valuation.

Cutting through the logic now, if you use story pitching so the investor trusts you personally, you keep more control, and you have higher financial returns at exit. So really, that’s all we need to say at this point. In two subsequent blogs, we’ll discuss how reducing the discount factor works in specific financial detail. And secondly, we’ll go over exactly how you use story pitching to increase trust and therefore reduce disbelief, and therefore reduce the discount factor. And in the end, you get more money and more control.

Thanks for listening, and we’ll be back shortly with the rest of these blogs.

If you can’t wait, connect with me.